omaha ne sales tax rate 2019

May 26 2019. The state capitol Omaha has a.

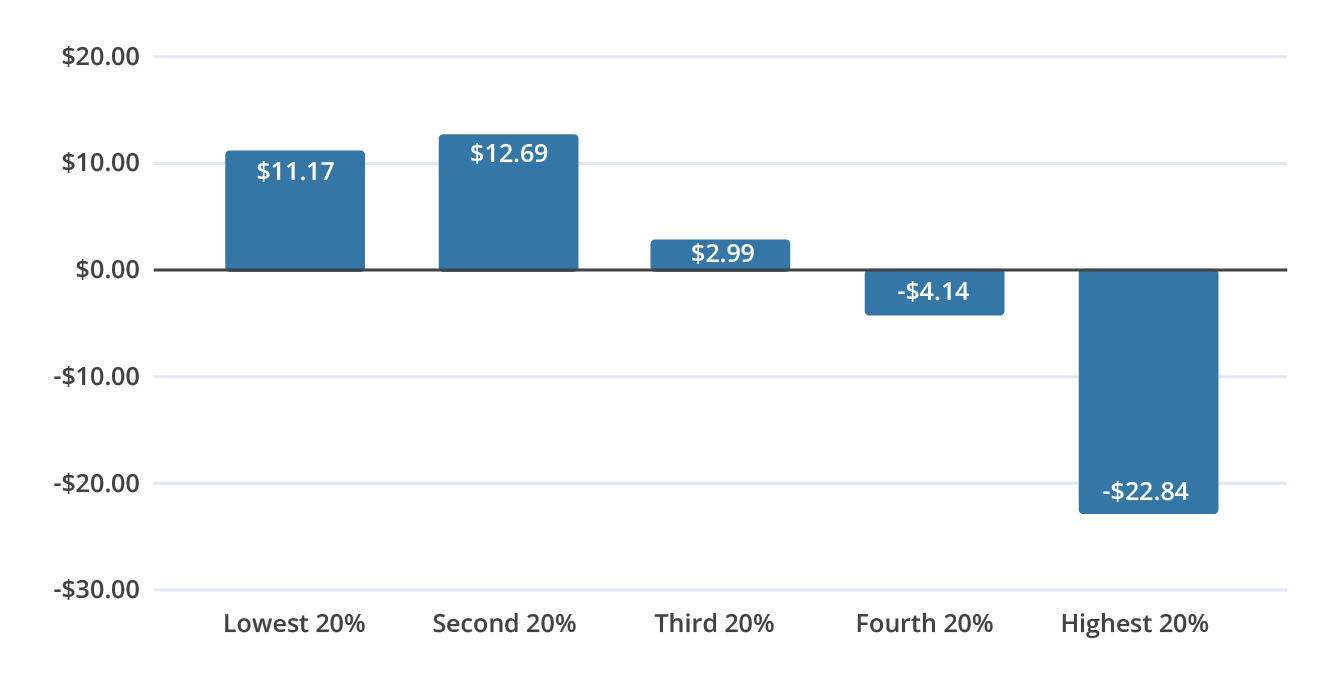

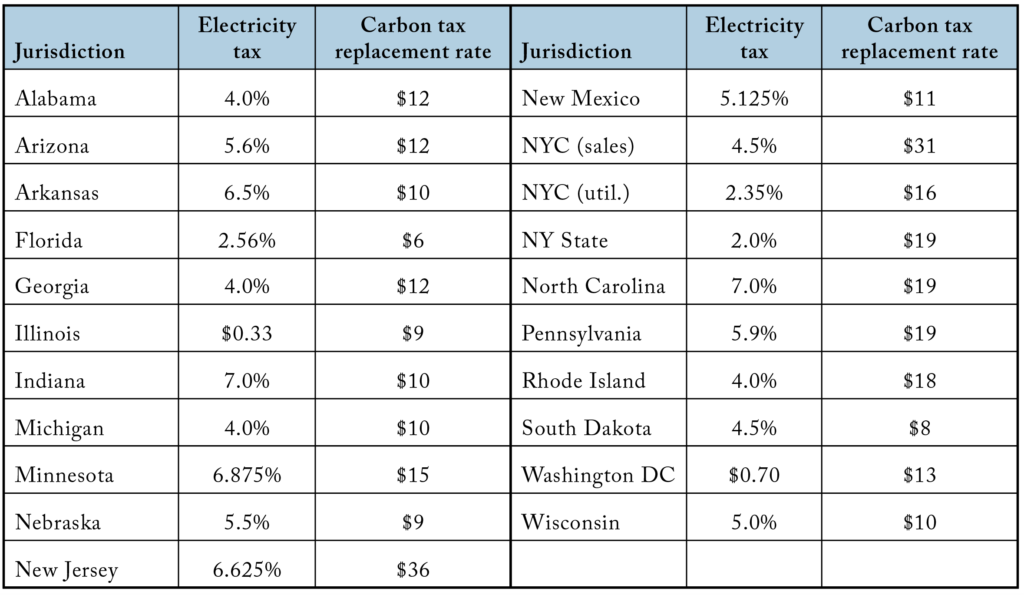

Carbon Taxes Without Tears The Cgo

Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter.

. 2020 rates included for use while preparing your income tax deduction. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. State Tax Rates.

Request a Business Tax Payment Plan. The minimum combined 2022 sales tax rate for Omaha Nebraska is 875. There is no applicable county tax city tax or special tax.

The latest sales tax rate for Omaha NE. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019. This is the total of state county and city sales tax rates.

Average Sales Tax With Local. The minimum combined 2022 sales tax rate for Omaha Nebraska is. AP Republican gubernatorial challenger Tim James on Wednesday called for a.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Papillion NE Sales Tax Rate. Coleridge Nehawka and Wauneta will each levy a new.

Make a Payment Only. Nebraska sales tax changes effective July 1 2019. Counties and cities can charge an.

Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The Nebraska state sales and use tax rate is 55 055.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. This is the total of state county and city sales tax rates. Groceries are exempt from the Nebraska sales tax.

January 2019 sales tax changes. The local sales tax rate in Omaha Nebraska is 7 as of September 2022. Sales and Use Tax.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. The Nebraska state sales and use tax rate is 55 055. More are slated for April 1 2019.

Nebraska Department of Revenue. The Omaha sales tax has been changed within the last year. Sales Tax Rate Finder.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Nebraskas sales tax rate is 55 percent. The Nebraska state sales and use tax rate is 55 055.

It was lowered 05 from 825 to 775 in September 2022 raised 05 from 775 to 825 in September 2022 lowered 0. Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax bringing the.

800-742-7474 NE and IA. This rate includes any state county city and local sales taxes. Iowas is 6 percent.

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. What is the sales tax rate in Omaha Nebraska. Local sales taxes may.

Sales Tax On Cars And Vehicles In Nebraska

2020 Nebraska Property Tax Issues Agricultural Economics

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Georgia Sales Tax Rates By City County 2022

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

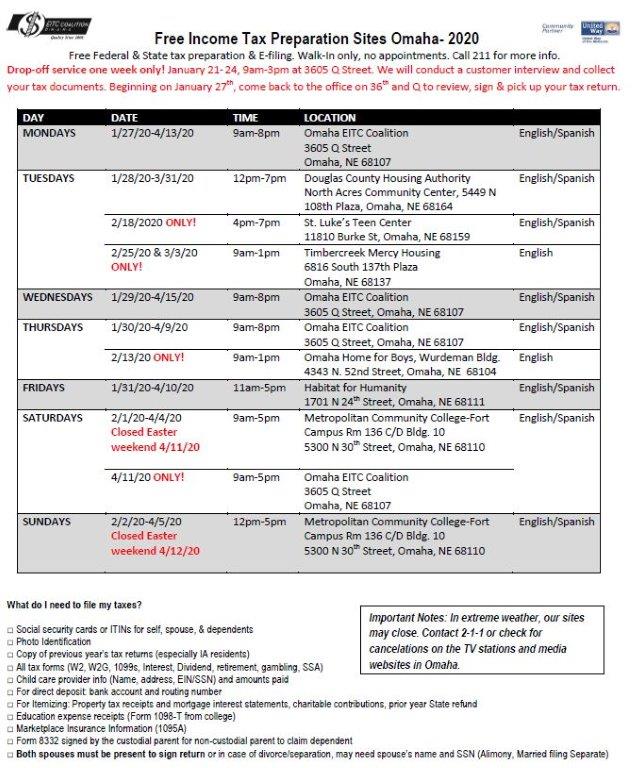

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

What Are The Rationales Behind Raising Taxes Like Left Wing Politicians In The Us Tend To Do And Lowering Taxes Right Wing Which Works Better Quora

New Ag Census Shows Disparities In Property Taxes By State

The Economic Effects Of The Marijuana Industry In Colorado Federal Reserve Bank Of Kansas City

Sales Tax Rates In Major Cities Tax Data Tax Foundation

These Are The Best And Worst States For Taxes In 2019

Nebraska Sales Use Tax Guide Avalara

Sales Tax Rates In Major Cities Tax Data Tax Foundation

5 Essential Steps To Reform Taxes In Nebraska

What Are The Rationales Behind Raising Taxes Like Left Wing Politicians In The Us Tend To Do And Lowering Taxes Right Wing Which Works Better Quora

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

The Economic Effects Of The Marijuana Industry In Colorado Federal Reserve Bank Of Kansas City